Justin Sun traded USDC fear after SVB collapse

At the height of USD Coin (USDC) panic — when news broke that much of its backing was stuck in recently-collapsed Silicon Valley Bank — Tron (TRX) founder Justin Sun traded millions of USDC.

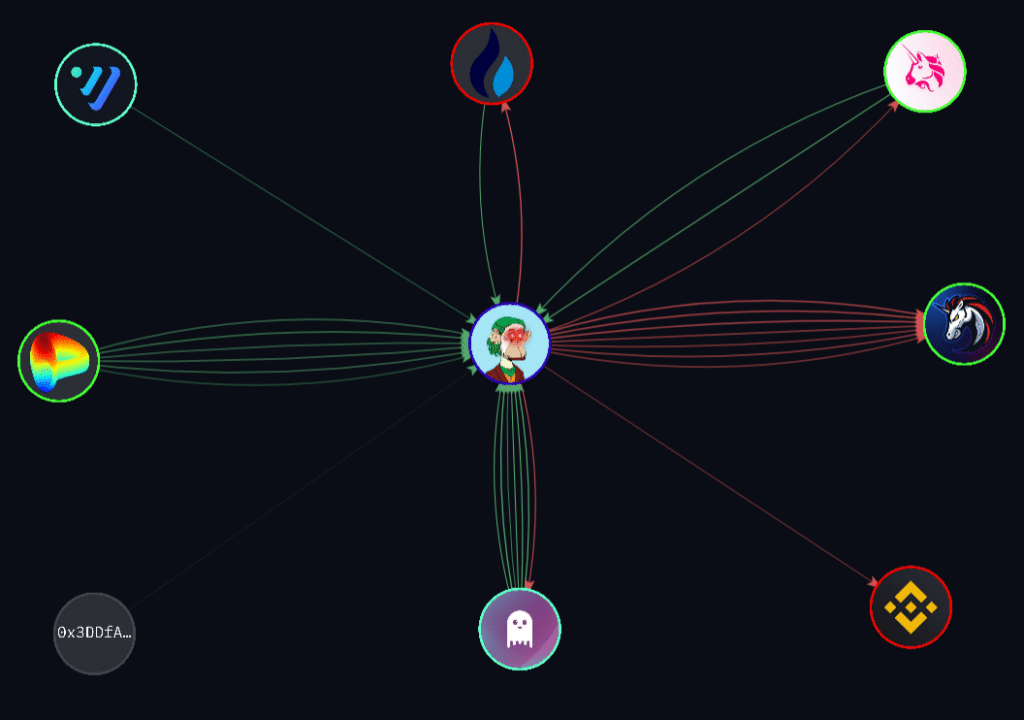

Arkham Intelligence data showed that on March 11, Sun’s publicly known wallets broadcast 31 USD Coin transactions cumulatively worth a total of nearly $550 million. Of those transfers, 20 worth a total of nearly $309 million were inflows and 14 worth just under $317 million were outflows.

In the first transaction of the series, Sun sold 72 million USDC through decentralized exchange (DEX) aggregator 1inch Network (1INCH) at 5am. CoinMarketCap data shows that at that time, USDC was trading at just under $1 — which indicates that Sun expected the price to drop on the news.

All times proceed in chronological order from 5am, March 11.

Then, at 5:06 — at a presumed discount of about 1% — Sun withdrew 11.626 million USDC from decentralized lending protocol Aave (AAVE) and sold them at 5:11 on 1inch Network. Similarly, at 5:37 — at a discount of about 4% — he withdrew 10 million USDC from the TrueUSD (TUSD) USDC Uniswap (UNI) DEX liquidity pool and sold them on 1inch Network.

Sun did the same with 9.5 million USDC from the USDD USDC Uniswap liquidity pool at 5:53 at a presumed discount of about 3%. Then, at 6:12 — when USDC was trading at a 4% to 6% discount — Sun withdrew nearly 4.8 million USDC from decentralized finance (DeFi) protocol Curve (CRV) and sold it all on 1inch Network.

He then kept doing the same with another 7.55 million USDC from Curve that was sold at a discount of about 6% on Unswap. Interestingly, this was a swap for decentralized stablecoin DAI which was partly backed by USDC and also suffered high instability at the time.

At 7:24, Sun was also able to send another million of USDC from DeFi platform Venus Protocol to his Binance deposit address — at a presumed discount between 4% and 8%.

Then, as he kept scrambling to minimize potential losses from a possible USDC collapse after 7:40, he also sold another 12.2 million USDC from Curve on 1inch Network and deposited another million USDC on Binance.

While Justin sun showed the ability to act quickly and anticipate a major USDC sell-off that later brought the stablecoin to a maximum discount of 12%, he ended up only limiting potential losses and would most probably still have been better off not doing anything.

This cannot be said about ethereum (ETH) co-founder Vitalik Buterin who showed steel nerves and trust in USDC and acquired a good amount of tokens at a discount in a successful trade.