While TrueUSD (TUSD) denies its exposure to crypto custodian Prime Trust, it has depegged for the second time this month. Prime Trust was placed into receivership on Tuesday after rival BitGo called off its bid to acquire Prime Trust.

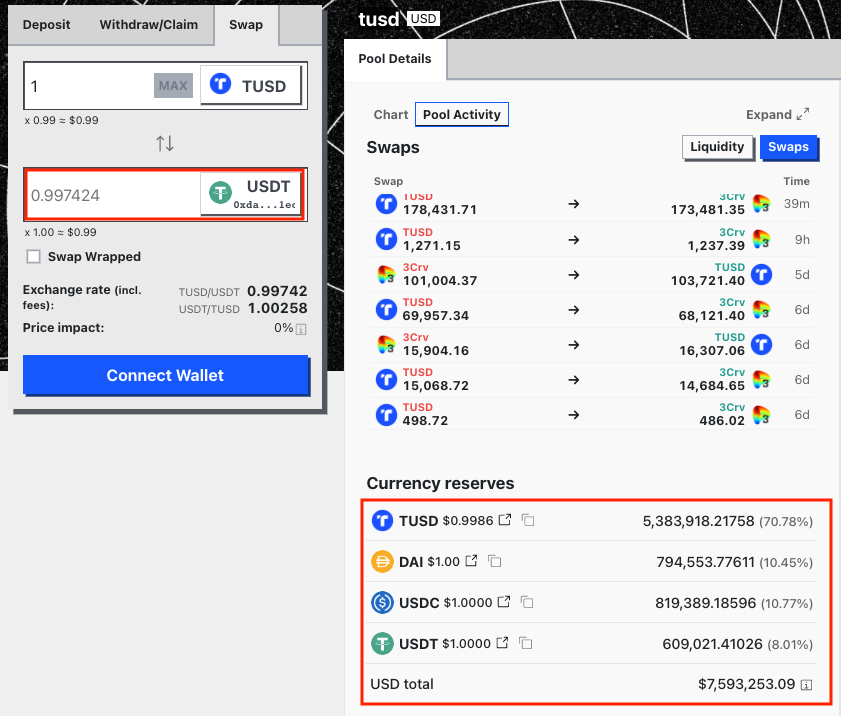

TUSD stablecoin fell to 0.9974 against Tether (USDT) on Binance and 0.80 on Binance.US amid exposure to Prime Trust. Maverick Protocol (MAV) launchpool on Binance starting to withdraw TUSD. Moreover, reserves on Curve pool has imbalanced further, rising more than 70%. The TUSD deposit and loan interest rates in Aave V2 soared, with the deposit interest rate reaching 42% and loan interest rate reaching 54%.

As a result, whales and investors are taking arbitrage opportunities to swap TUSD for USDC and other stablecoins. TUSD has $20 million in plunge protection buys down to $0.997, but $21 million would take it down to $0.70 on Binance.

Notable crypto experts including Adam Cochran, The Wolf Of All Streets, and Parrot Capital took to Twitter to warn about TUSD depeg risks. Moreover, TUSD reserves attestation was provided by The Network Firm (formerly Armanino), the same audit firm that was in charge of FTX.US audits. Adam Cochran said:

“Wait, the auditor who has been attesting to the TUSD audits (in Prime Trust) was the old FTX auditor who set up under a new name after the FTX scandal?!?!? These guys literally audited the biggest grift in history and just renamed themselves?!?”

Recommended Articles

Also Read: Shibarium Testnet Reaches 25 Million Transactions, SHIB & BONE To Rally?

Binance Exposure to TUSD and Prime Trust

Binance started supporting TUSD stablecoin after the US regulator ordered Paxos to stop minting Binance USD (BUSD) stablecoin.

TUSD reserves are majority held in Prime Trust, First Digital, Capital Union, Manual, and BitGo. According to TUSD real-time reserve balance, the token supply stands at 3.139 billion TUSD and USD-denominated collateral held in accounts is $3.14 billion.

CoinGape Media earlier reported Prime Trust started holding Binance customers’ cash via partner banks in March. The custodian was linked to FTX and its executives.

Also Read: Bloomberg Analysts Increasingly Bullish On BTC Price Amid BlackRock, Fidelity Bitcoin ETF

- US House to Vote on Two Landmark Crypto Bills Next Week

- WIF Selloff Alert: Dogwifhat Tumbles On Multiple Factors

- Popular Analyst Reveals Trading Alert for Bitcoin ETF, BTC Price To $80K?

- XRP Lawsuit: Pro-XRP Lawyer Forecasts Minimal Fines in Ripple vs SEC Case

- Pendle Token Theft Surges, $5.62M Lost From Recent Permit Phishing

- Shiba Inu Price Analysis Hints 35% Upside as Buyers Break 50-Day Consolidation

- Solana Price Prediction: Can SOL Surpass the $200 Milestone By End Of This Weekend?

- Ethereum Price Analysis: ETH Sees End-of-Correction With This Resistance Breakout

- Turn $1 Into $100 This Week With 3 Altcoins To Buy

- Crypto Market Analysis 18/5: Will Bitcoin Regain $70000 this Weekend?