MakerDAO: It’s a bumpy ride to recovery as MKR declines 37% and TVL drops 10%

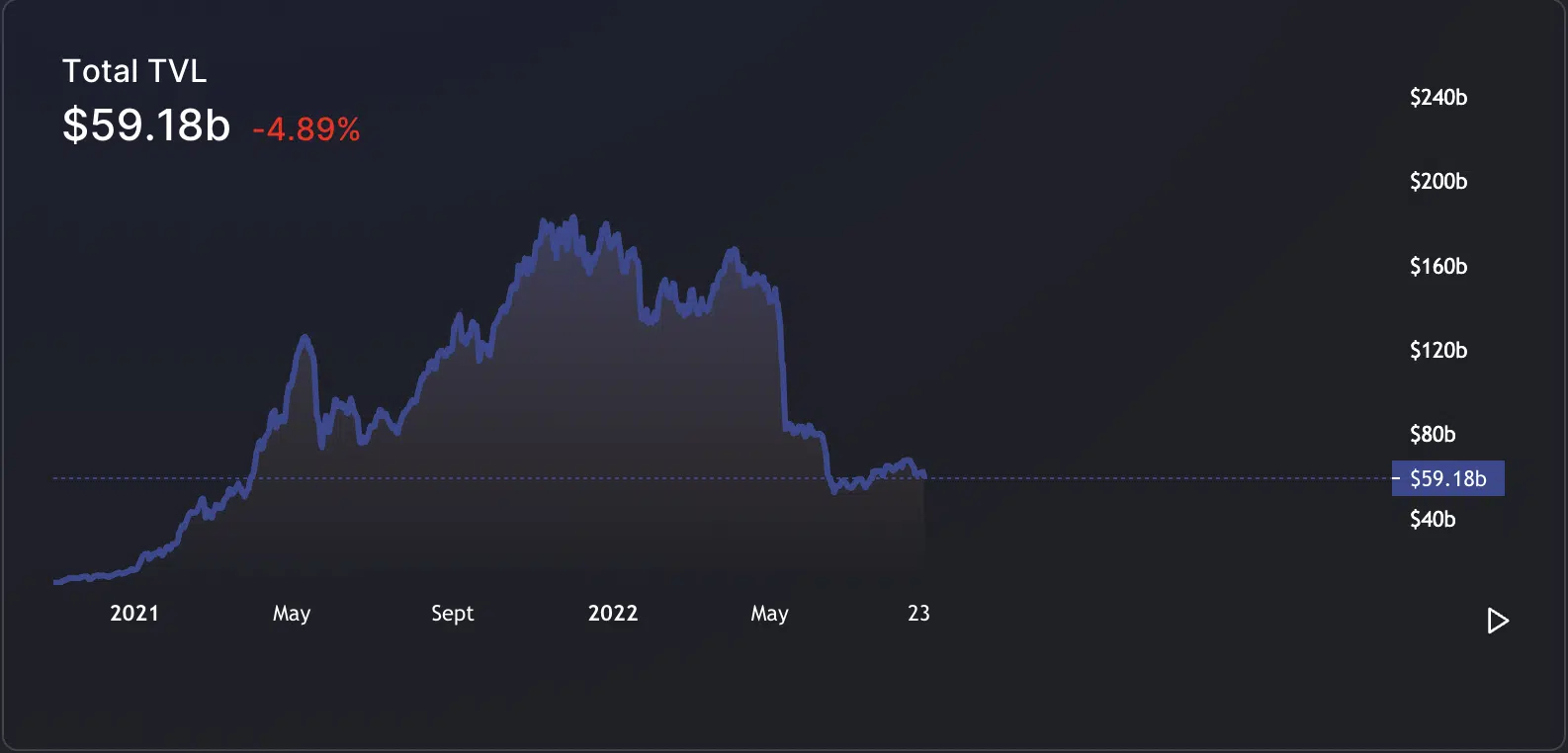

The current Total Value Locked (TVL) across all DeFi platforms stood at $59.18 billion at the time of writing. DeFi platforms have been severely affected by general downturn that has plagued the cryptocurrency market since the beginning of August.

At $64.27 billion at the beginning of the month, the TVL in the DeFi market has dropped by 8%. In the first half of the year, the general market decline and the series of DeFi hacks and exploits caused the TVL to go down by 68%.

Impacted by the general market bullish recovery in July, data from DefiLlama revealed that the TVL rebounded and regained over 20% of its value. As of this writing, the general DeFi market TVL was at its April 2021 level.

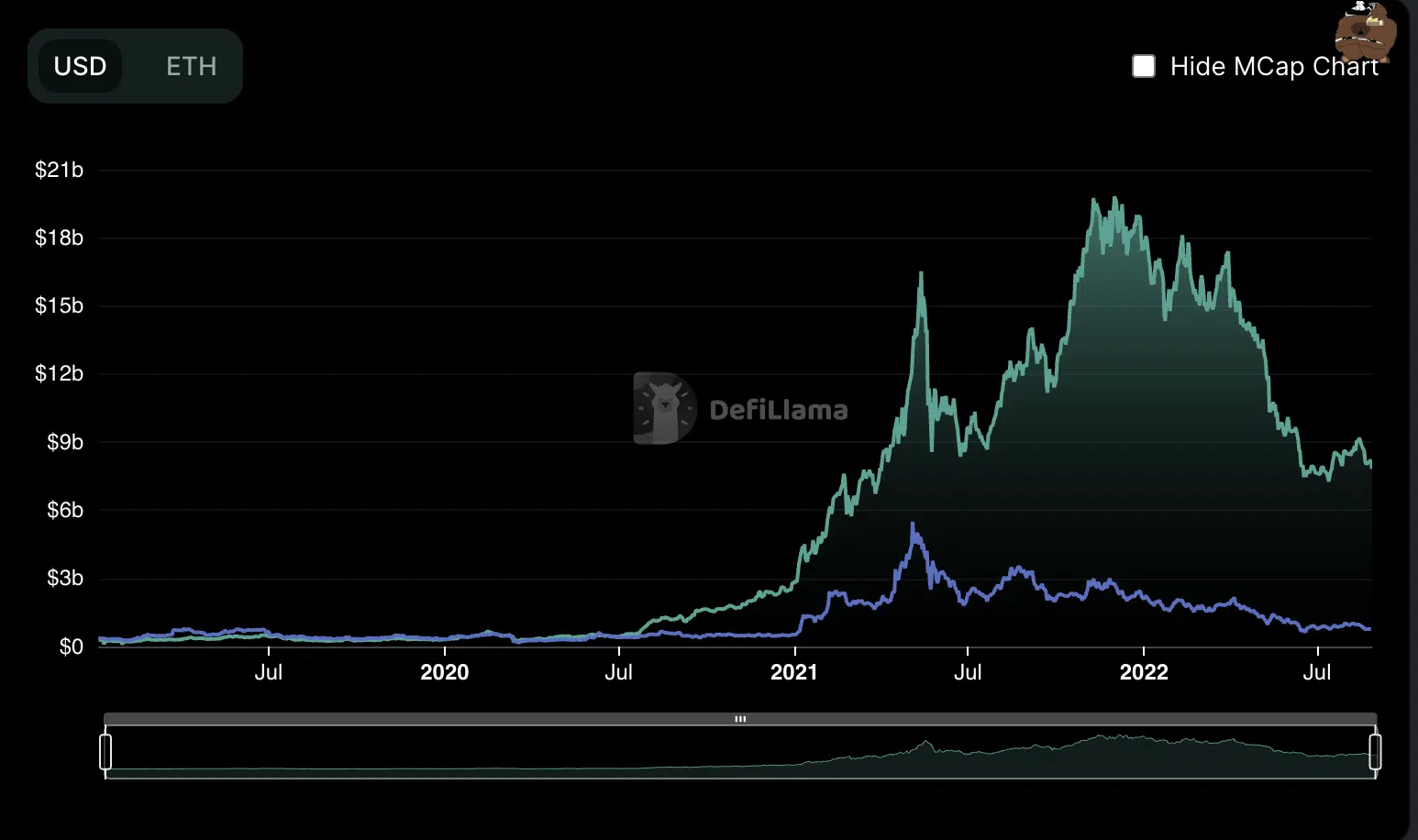

With a TVL of $7.79 billion, MakerDao currently controls 13.16% of the entire market. So how has the protocol fared so far this month under the impact of a generally bearish market?

So far, not so good…

After witnessing a boom in the DeFi space in late 2021, MakerDao stepped into the new year with a TVL of $17.5 billion. But, with a reversal in the protocol’s fortune, its TVL declined by over 55% in the year’s first six months. By June 30, MakerDAO’s TVL had fallen by half of its January value.

Not left behind from the temporary retracement that the entire market saw in July, MakerDAO’s TVL quickly rallied by 12% and ended the month with a TVL of $8.63 billion.

With the cryptocurrency market reeling under the impact of the dropdown of the broader financial markets, MakerDAO’s TVL has gone down by 10% in the last 26 days.

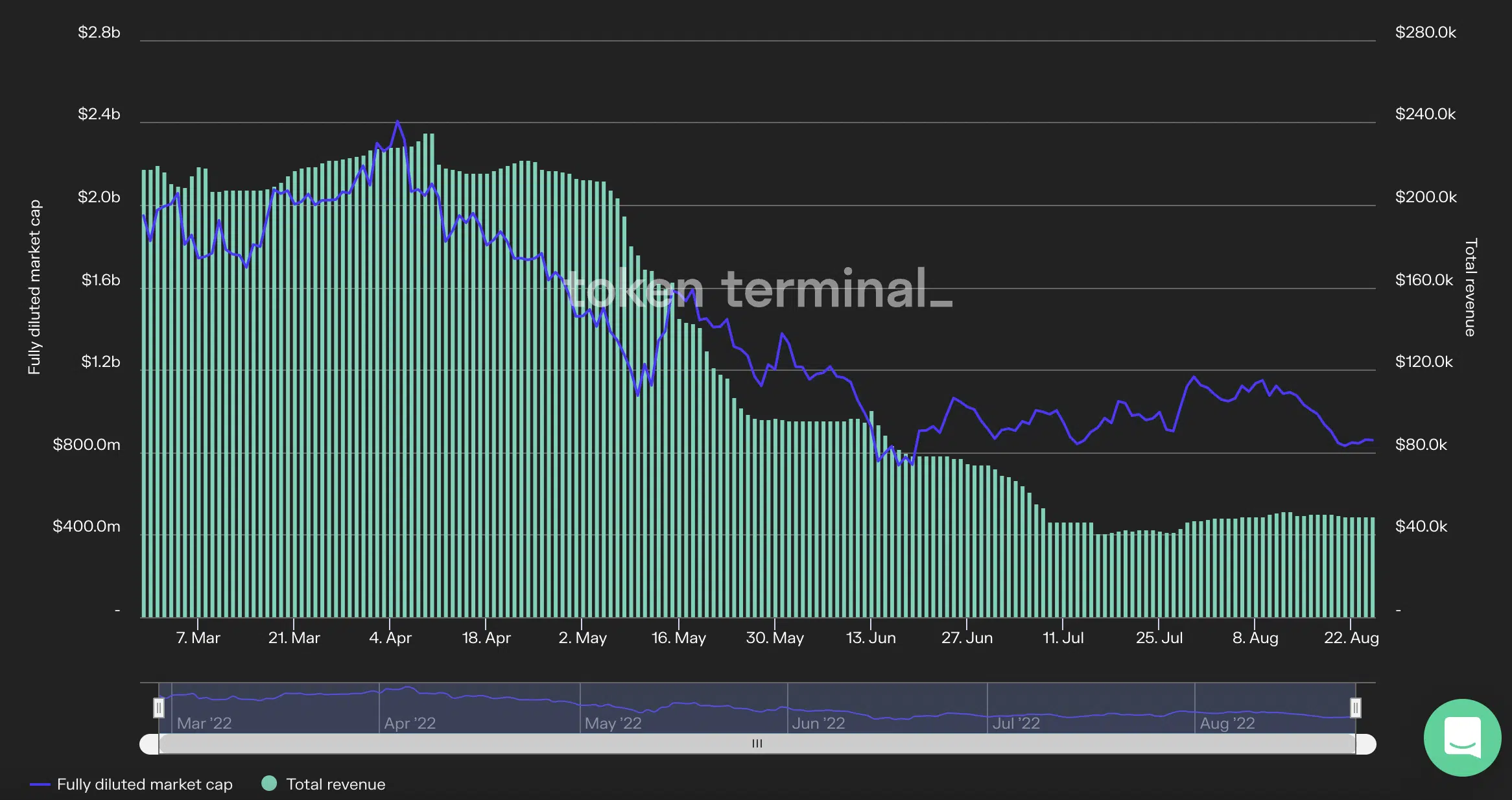

As for daily revenue on the protocol, data from Token Terimanal revealed that this had dropped consistently in the last few months. In the last month, this had gone down by 8%.

In the last 180 days, the daily revenue pocketed by MakerDAO had declined by 52.9%. Within the same period, the protocol’s fully diluted market capitalization had decreased by 45%.

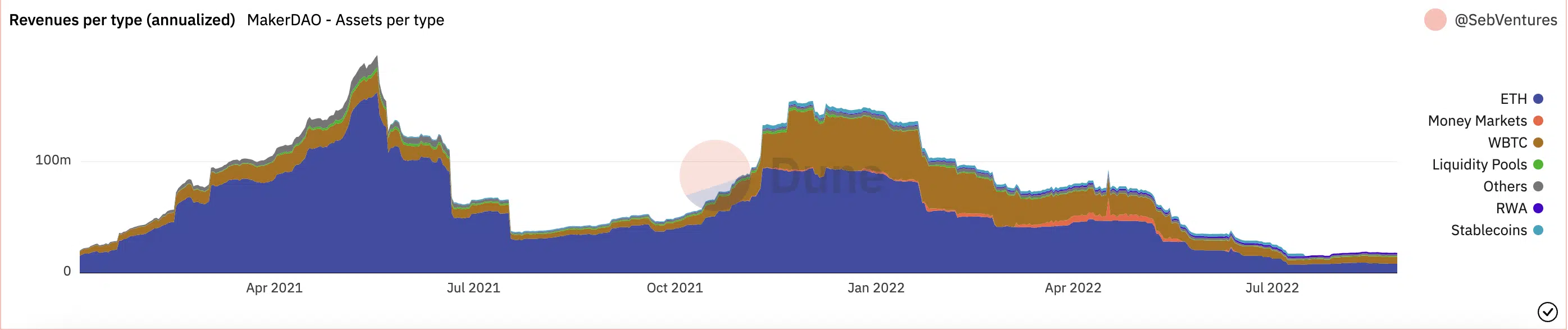

Further, data from Dune Analytics revealed a consistent decline in the annualized revenue brought in by the various class of assets housed within the protocol since the beginning of the year. At press time, the value of total assets held by MakerDAO stood at $6,571,802,698.

What about MKR?

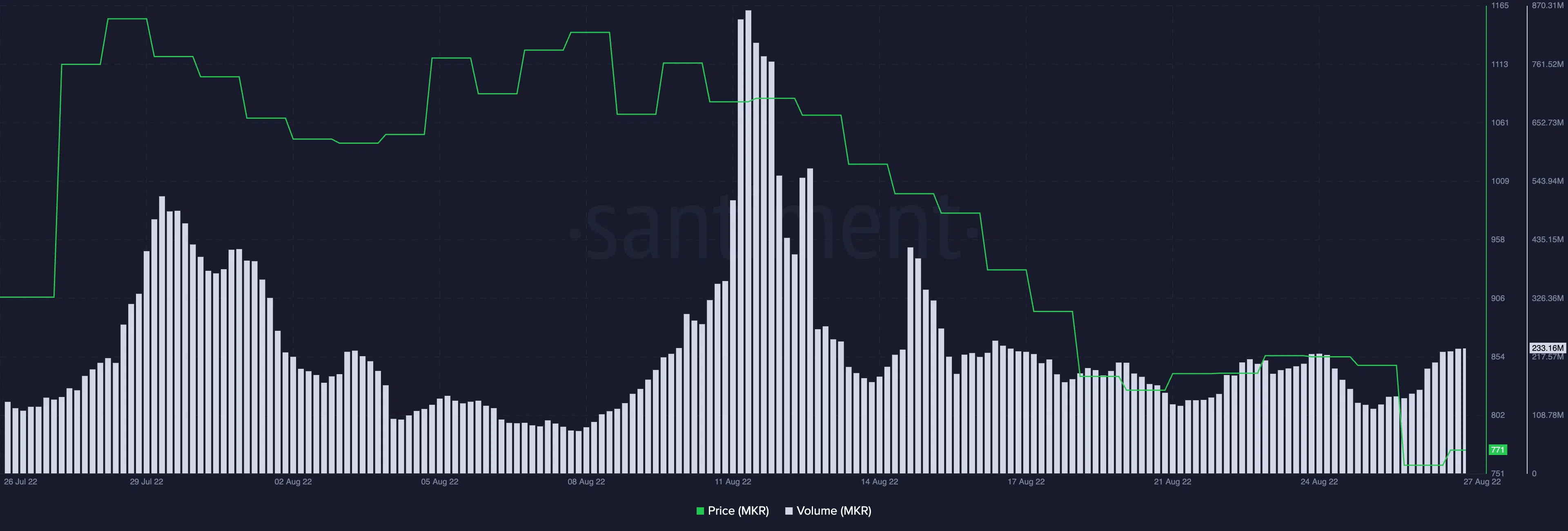

According to CoinMarketCap, the protocol’s native token, MKR, exchanged hands at $772.05 at press time. Pegged at $1,065 when August started, it has since declined by 37%. Trading volume on the network rallied to a daily high of $861.7 million, after which it since fell.