Venture capital companies have been offloading their balances of MakerDAO’s MKR token. This scenario would put downward pressure on token prices, but it is actually a big plus for protocol decentralization and future price action.

Researchers have been delving into the balances of MakerDAO tokens by venture capital giants such as Andreessen Horowitz (a16z).

MakerDAO Steps Towards Decentralization

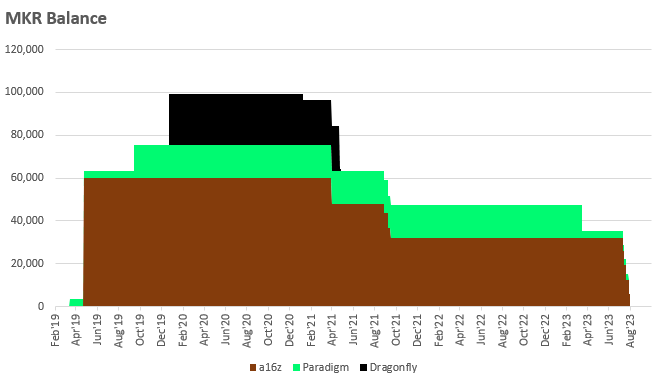

On Aug. 1, Menya Research analysts reported that a16z is finally selling the last of its MakerDAO balances. Furthermore, VC firms such as Paradigm and Dragonfly have also sold their MKR holdings.

“This selling has been a significant overhang for Maker bulls,” they noted.

According to the analyst, the three venture giants collectively held around 11.5% of Maker tokens at one point.

They reported that a16z bought $15 million, or 6% of the MKR supply, in September 2018 with an average price of $250.

Paradigm and Dragonfly bought $27.5 million, or 5.5% of the supply, in December 2019 with an average price of $500.

A16z has been selling since March 2021 with an average sale price of $1,800, marking a 7.2x gain from its initial investment. Over the past month, it has “aggressively sent its remaining 32,000 MKR to exchanges to sell.”

Paradigm and Dragonfly have also been selling in batches and have gained handsomely on their purchases.

Find out how to choose a Cryptocurrency Lending Platform

VC control over DeFi projects through massive token holdings has been a cause for concern. Many projects, such as Uniswap, have their governance voting systems completely taken over by VC whales holding massive bags.

Furthermore, VCs often receive their tokens in private sales at massive discounts and sometimes dump their bags onto retail investors.

The MakerDAO VC sales should have increased downward pressure on MKR prices, but they have been increasing steadily since the beginning of July. The analyst concluded that without the VC selling pressure, the outlook for MKR is bullish.

MKR Price and Endgame Plan

MakerDAO has been aggressively investing in traditional finance assets as part of its “Endgame Plan.” Specifically, it has been looking into US government bonds and treasuries this year.

MKR prices are up 7.8% on the day to trade at $1,329 at the time of writing. The DeFi token has had a solid month gaining 47% over the past 30 days.

However, it remains down 79% from its all-time high of $6,292 in May 2021.

Nevertheless, now that the VCs have offloaded their bags, the project is more decentralized, and price action is back with the bulls.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.