The native token for blockchain oracle provider Chainlink is outperforming the rest of the crypto market today. LINK is pumping, and it may be due to dormant wallets resuming activity, according to on-chain analytics provider Santiment.

On February 2, blockchain analytics firm Santiment reported that LINK jumped ahead of the altcoin pack,

“After some previously dormant wallets created the highest Age Consumed spike.”

Chainlink Wallet Movements and LINK Price

Santiment made the observation by multiplying coins moved by the number of days those coins had been dormant. It stated,

“This influx of LINK back into the network’s circulation has likely contributed to the price jump.”

It added that the Chainkink network had seen minor liquidations of wallets,

“Which is often a sign of FUD that can contribute to further price rises.”

The breakout has pushed LINK prices to an intraday and 22-month high of $18.13 during the Friday morning Asian trading session.

The last time LINK topped $18 was in April 2022. The next major resistance level, and the last spike in January 2022, was $28.

The big move has pushed Chainlink gains to 30% over the past seven days, according to CoinGecko. It is also very close to flipping Tron (TRX) for twelfth place as LINK market capitalization has now surpassed $10 billion.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

Chainlink hype and FOMO have been largely driven by real-world asset tokenization momentum. On February 2, the network reminded its X followers that it is the industry leader in this sector.

“Traditional financial institutions need data, compute, and cross-chain capabilities to adopt blockchains and tokenized RWAs at scale. Only the Chainlink platform provides all three.”

On February 1, trader and analyst “Satoshi Flipper” said that the first cross-chain swaps protocol on Chainlink powered by CCIP called Xswap was live. The crypto oracle provider launched the Cross Chain Interoperability Protocol (CCIP) in July to enable seamless cross-chain transactions.

Other Altcoins Gaining Ground

LINK is the leading altcoin in the crypto top 30, but several other crypto assets are performing well this Friday.

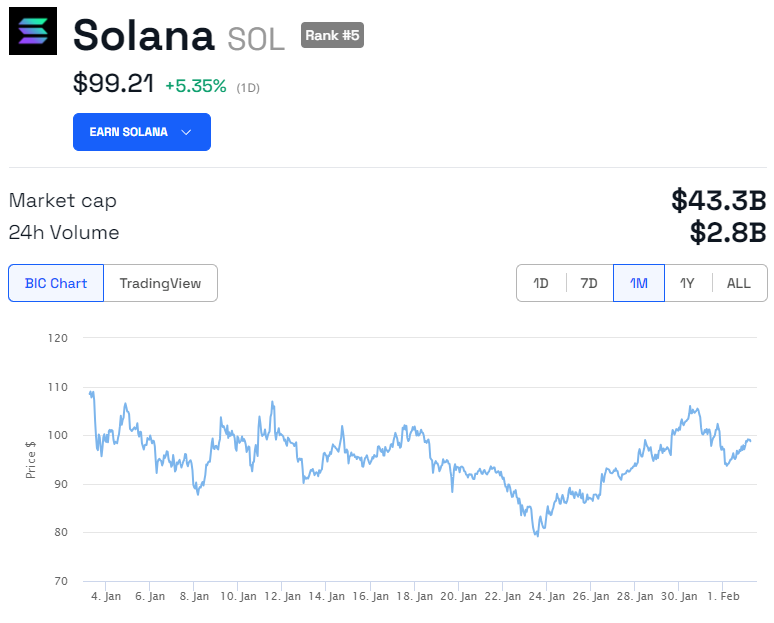

Solana (SOL) has made 5.3% as the blockchain token closes in on $100 again.

Additionally, layer-2 platform token Polygon (MATIC) is up 4.9% to top $0.80 at the time of writing.

Internet Computer (ICP) has gained 9.2%. Meanwhile, Immutable (IMX) is up 15%, reaching $2.21 during Asian trading this Friday.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.