- Bitcoin loses its market share as altcoins are more successful.

- BTC/USD bulls have a chance to hit the target of $9,000.

Bitcoin passed several important barriers and hit $8,900 during early Asian hours. At the time of writing, BTC/USD is changing hands at $8,643, down 2% since the beginning of the day. Despite the retreat, it is still 2% higher from this time on Tuesday.

Notably, Bitcoin's market dominance dropped to 66.1%, which is the lowest level since the end of November. Thee decrease of the market share is caused by strong growth of Bitcoin forks, including Bitcoin Cash, Bitcoin SV, Bitcoin Gold and Bitcoin Diamond. Some other altcoins like DASH, ZCash and Ethereum Classic also experienced strong double-digit growth.

$9,000 within reach?

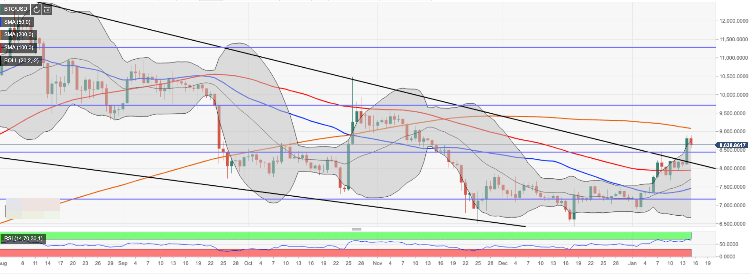

Now that Bitcoin broke above the descending wedge, many traders expect further recovery with the next aim at $9,000, followed by $9,700 (38.2% Fibo retracement for the upside move from December 2018 low to July 2019 high. This level may slow down the upside momentum and even trigger a downside correction before another bullish wave towards a psychological $10,000. Once $9,000 is out of the way, this target will move from a distant dream status to a total possibility.

On the downside, the initial support is created by $8,500 that served as resistance during the. previous week. Reinforced by 50% Fibo retracement, it is likely to limit the downside correction for the time being. If it is broken, the bearish sentiments may intensify with the next price target at $$8,150 (broken wedge) and $7,950 (SMA100 daily). Considering that the RSI on a daily chart has reversed to the downside, further correction likes likely at this stage

BTC/USD daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 meme coins price prediction Dogecoin, Shiba Inu, Bonk: Memes face steeper correction than Bitcoin

Dogecoin eyes February lows after nearly 23% decline in the past seven days. Shiba Inu could plummet another 13% amid the broader crypto market correction. Bonk price is likely to regain lost ground as technical indicators point at recovery.

XRP sustains above $0.50 as traders digest news of Ripple XRP Ledger entry in the Japanese market

Ripple (XRP) sustained above $0.50, a key support level, on Wednesday. XRP price is down nearly 6% in the past ten days. The altcoin is in a confirmed downward trend, and wiped out all gains since February.

Optimism OP struggles to gain momentum despite alleged $90 million OP purchase by a16z

Venture capital firm a16z has purchased $90 million in OP tokens under a two-year vesting period, Unchained crypto reports. Sources told Unchained Crypto that Optimism has done well and the project is still doing airdrops.

Sei price action forecasts an opportunity to accumulate SEI Premium

Sei (SEI) price is at a crossroads and could trigger a steep correction or potential bounce after setting up an all-time high (ATH) of $1.145 roughly a month ago. Based on the Bitcoin price action, a potential bounce will likely occur anytime now.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.