Highlights

- XRP shows resilience, Dark Defender predicts a bullish surge towards $0.60.

- Community enthusiasm grows as XRP's positive trajectory sparks diverse market perspectives.

- Pro-XRP lawyer Bill Morgan adds a unique viewpoint, predicting a potential Bitcoin downturn.

Cryptocurrency enthusiasts are on high alert as XRP, Ripple’s native token which witnessed tumultuous trading recently, appears to be regaining momentum. Meanwhile, renowned crypto analyst Dark Defender’s optimistic forecast on the X platform has triggered excitement, suggesting a potential breach of a key resistance level with eyes set on $0.60.

So, let’s explore the dynamics at play, considering technical indicators and the community’s sentiment.

Analyst Predicts XRP Price To Hit $0.6

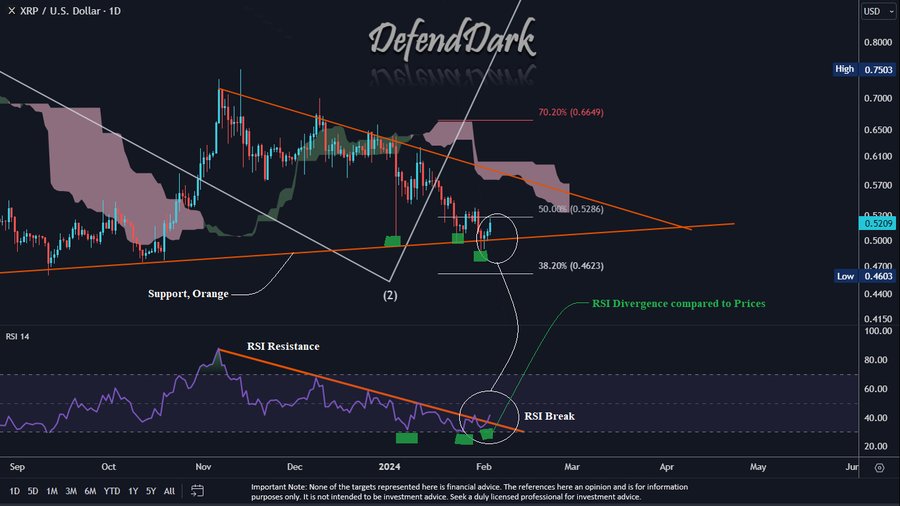

Dark Defender’s bullish analysis of XRP provides a fresh perspective on the digital asset’s trajectory. The technical indicator in focus is the Relative Strength Index (RSI), which currently signals increased resilience compared to the previous week. Despite the price being lower, a bullish divergence is evident, hinting at a potential upward surge.

Meanwhile, Dark Defender highlights XRP’s strength, citing a daily RSI indicator break, signaling an imminent breach of $0.5286. In addition, he predicts the next target, a minor resistance at $0.60, awaits validation.

For context, the RSI, serving as a momentum indicator, measures recent price changes’ speed and magnitude. Traditionally, an RSI above 70 suggests overbought conditions, while below 30 indicates oversold conditions. Dark Defender’s analysis indicates a favorable setup for XRP, fueling optimism among traders and investors.

Recommended Articles

Also Read: Is PYTH The Next Chainlink? Here’s Why PYTH Price Can Rally To $1

Bill Morgan Provides Unique Perspective

The XRP community amplifies the bullish sentiment as enthusiasts share price rally charts and express confidence in the digital asset’s upward trajectory. Notably, pro-XRP lawyer Bill Morgan interprets the positive outlook as a potential downturn for Bitcoin, adding an intriguing perspective to the market dynamics.

In another post, Bill Morgan highlights a personal encounter, underscoring the diverse reactions to market data. He reveals an unexpected revelation from a family member, who, despite never discussing crypto before, holds 100,000 XRP and plans to buy an additional 30,000 XRP due to the recent downtrend. This revelation also reflects the traditional practice of “buy-the-dip”, widely used by global investors.

As XRP continues to capture attention with its price movements and community discussions, market participants eagerly await further developments and potential breakthroughs in the coming days. However, on Saturday, the XRP price was up around 4% and traded near the $0.52 mark, while its trading volume over the last 24 hours also soared.

Also Read: ZetaChain (ZETA) Price Rally Takes A Pause As Liquidations Hit $2 Million

- Ethereum (ETH) Price Jumps 5%, This Breakout Can Trigger Bull Run

- Crypto Prices Today May 18: Bitcoin Nears $67K As Ethereum, Solana, XRP Rally

- Dogecoin Whale Offloads 120M Coins To Robinhood, DOGE Price At Risk?

- Spot Bitcoin ETFs Net $1.3B in May, Reversing April’s $344M Outflows

- Ripple Spotlights $865M XRP Volume Amid SEC Lawsuit: Report

- Bitcoin Price Analysis: Why BTC Rise to $67k Hints End of Correction Trend

- Expert’s Top 3 Bitcoin Spinoffs With 100X Potential Before June

- Chainlink Price Analysis: Whale Accumulation Positions LINK for $20 Breakout

- Bonk Price Prediction: Bullish Reversal Pattern Signals Upside Potential of 22%

- XRP Price Forecast: Could a Bullish Momentum Drive the Price to $1 Amid SEC Ruling?